If you’d like to finance your next used car purchase, you’ll have several options open to you.

Arranging your finance through the dealership is often the best way to fund your used car and offers many advantages to borrowing from a bank or other loan provider.

Dealer finance allows you to get a finance agreement that suits your borrowing requirements.

The interest rate is fixed which means that you know exactly what your monthly payments will be for the duration of the agreement and won’t change.

Dealer finance also often offers a better rate of interest and may also mean you’re more likely to be approved.

Arranging finance with Sparshatts in partnership with Santander Consumer Finance is quick and easy. We can get approval turned around in minutes! Our expertise with finance means that even if you think you might have a poor credit rating we can help arrange finance for you.

This short video provides a simple explanation of Purchase Plan and how it works.

A simple way of financing that gives you the certainty of a fixed interest rate, and fixed monthly payments throughout the agreement. The initial deposit and repayment period can be structured to help meet your budget and the length of time you expect to keep the car. You can trade in your existing car and put this towards the initial deposit, or if you wish, just put down a cash deposit.

A guaranteed fixed monthly payment, allowing you to budget with confidence.

This short video provides a simple explanation of Personal Contract Purchase and how it works.

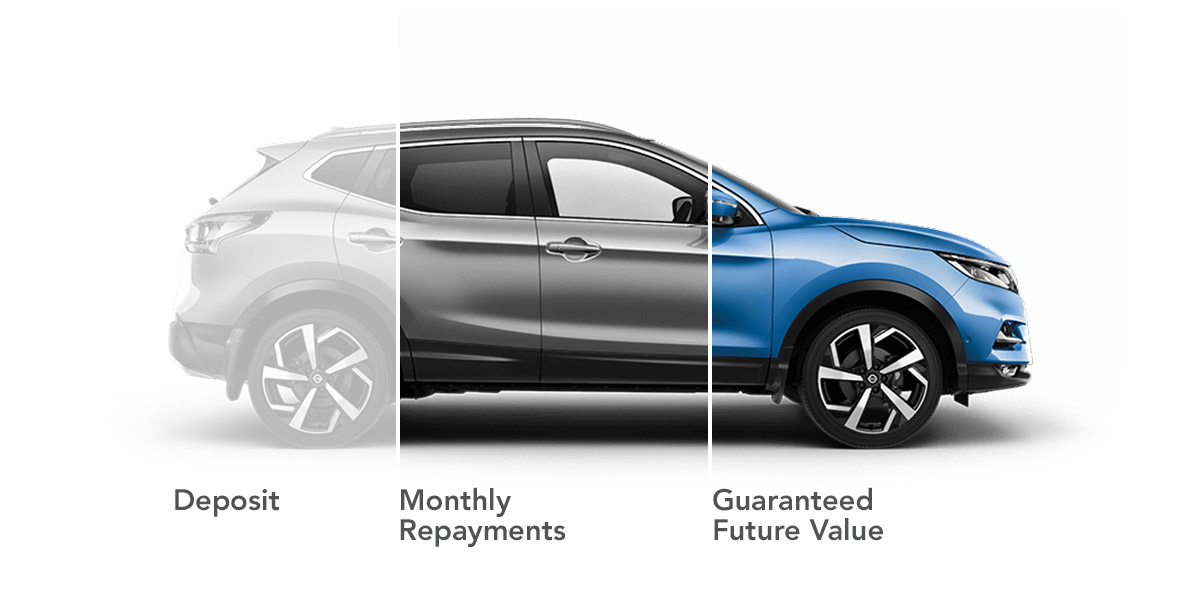

Similar to a Purchase Plan agreement but with additional flexibility since part of the cost is deferred until the end of the agreement which may give you the benefit of lower monthly payments. The deferred amount is known as the Guaranteed Future Value (GFV) sometimes known as Optional Final Payment.

A guaranteed fixed monthly payment, allowing you to budget with confidence.

Potentially lower payments than a Purchase Plan agreement.

Variety of options available at end of the agreement.

You can match the length of your agreement with the time you want to keep the vehicle.

Sparshatts Group Limited is an appointed representative of ITC Compliance Limited which is authorised and regulated by the Financial Conduct Authority (their registration number is 313486). Permitted activities include advising on and arranging general insurance contracts and acting as a credit broker not a lender.

We can introduce you to a limited number of finance providers. We do not charge fees for our Consumer Credit services. We typically receive a payment(s) or other benefits from finance providers should you decide to enter into an agreement with them, typically either a fixed fee or a fixed percentage of the amount you borrow. The payment we receive may vary between finance providers and product types. The payment received does not impact the finance rate offered.

Finance available from 8.9% APR. Representative 10.9% APR.

All finance applications are subject to status, terms and conditions apply, UK residents only, 18’s or over, Guarantees may be required.

Sparshatts Group Limited VAT Number: 327 7738 68